$9.9 billion

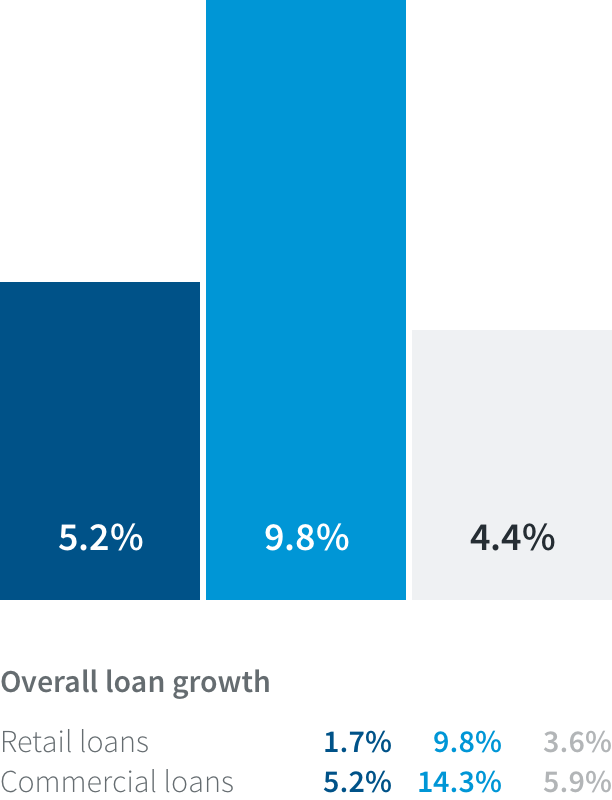

total assets increased 3.6%, or $347 million

Subsidiary revenue vs. Credit Union revenue ($ and % change)

Subsidiary revenue vs. Credit Union revenue ($ and % change)

![]()

“First West’s strong performance is a testament to our business model and our capacity to create stability during times of rapid change. Our local focus and commitment to innovation continue to drive top-tier financial results.”

$52.3 million

income before tax increased 48.6%, or $17.1 million

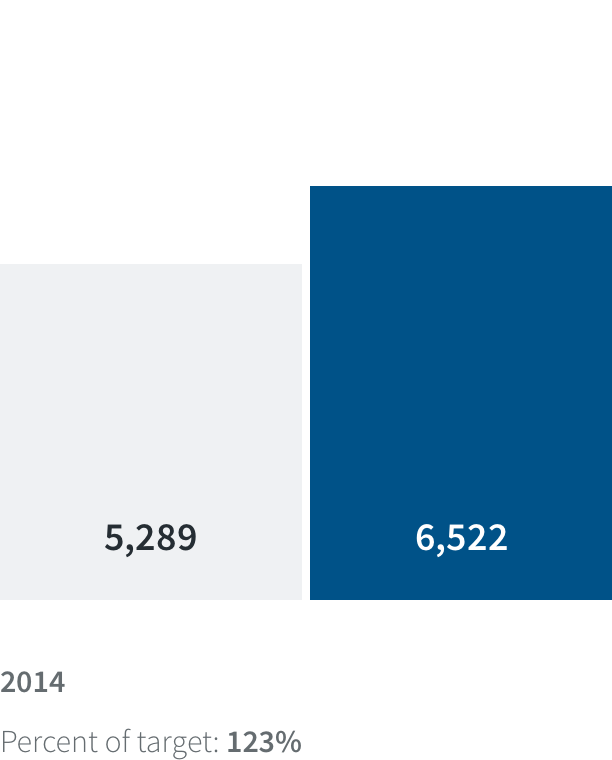

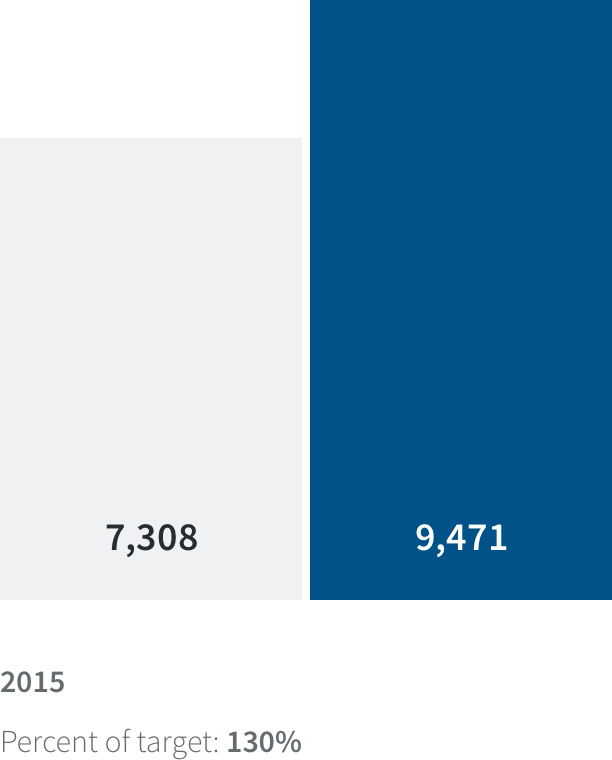

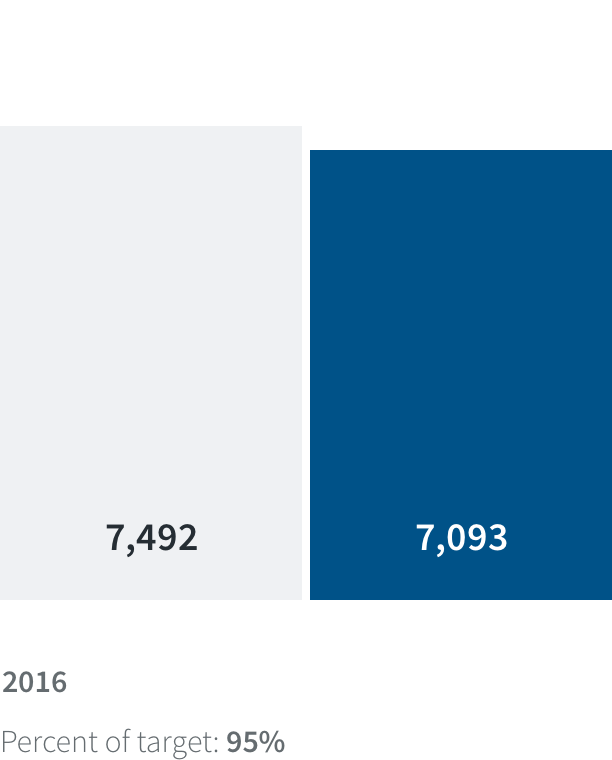

8,786 new members

8,786 new members

Membership grew by 3.7% in 2017, bringing our total net new members to more than 50,000 since the inception of First West in 2010

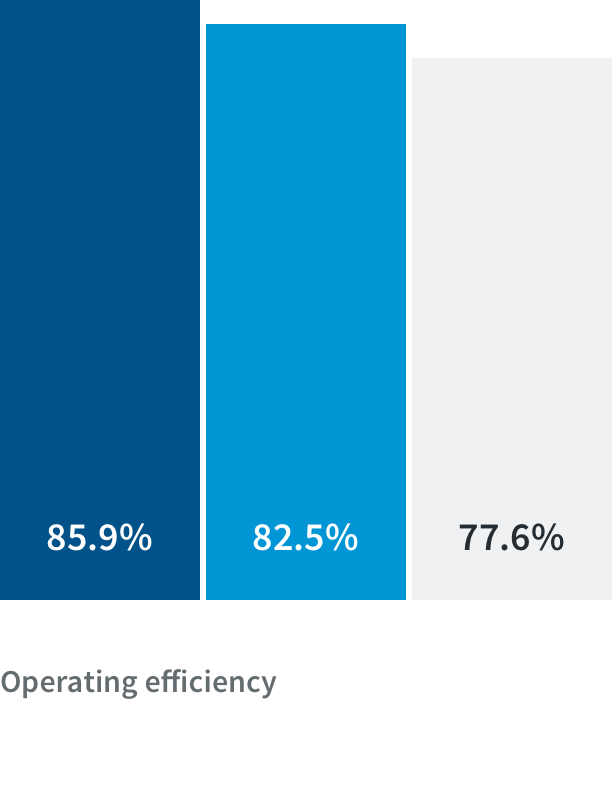

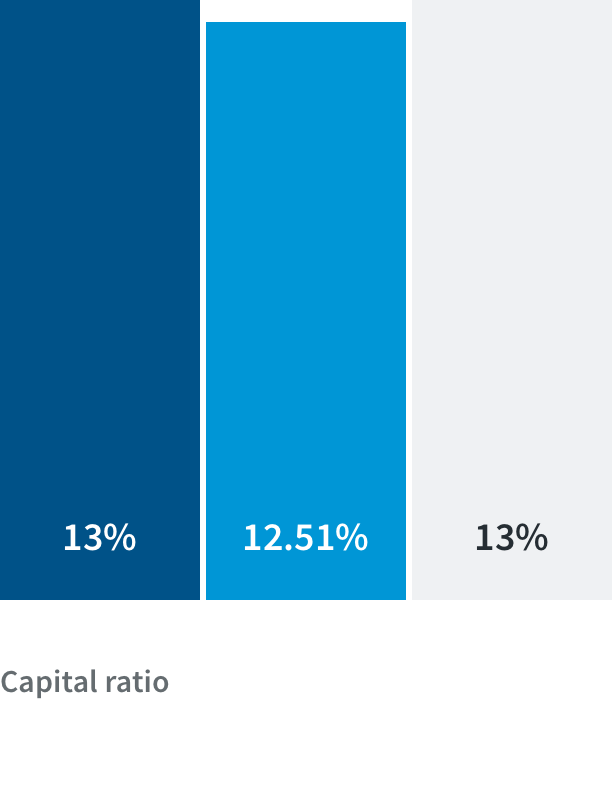

Performance Indicators

Membership Growth